property tax assistance program calgary

This service is provided at 2 Location s City of Calgary Municipal Building. Property tax assistance program Property tax assistance.

Why Homeowners Not Businesses Are Paying More And More Of The Property Taxes In Calgary Cbc News

The City of Calgary Property Tax Assistance Program Property tax Offered to all low- income homeowners experiencing financial hardship.

. Taxes and property assessment. Meet the residency and income guidelines of the Fair Entry Program. Meet the residency and income guidelines of the Fair Entry Program.

If you fulfill the program conditions you are eligible for tax rebate. Apply for property tax assistance Apply now. Since its introduction the city of Calgary has spent more than 200 million on the PTP.

Anyone who is approved will receive an additional rebate from Waste and Recycling Services. Phased Tax Program. Own no other City of Calgary residential property.

Web property for a minimum of one year from date of purchase. If you are experiencing financial hardship you can apply for Property Tax Assistance Program The City of Calgary. You must be a CUPS client and filing taxes in Alberta.

Own no other City of Calgary residential property. Social programs and services. Located next to historic City Hall LRT system and is connected via 15 system.

Apply for property tax assistance. Personal information is collected in accordance with Section 33c of the. If you qualify Seniors Property Tax Deferral Program will pay your residential property taxes directly.

Apply now through Fair Entry and your one. Property Tax Assistance Program This is an annual program that provides a creditgrant of the increase in property tax for your property. If you are a residential property owner experiencing financial hardship you may be eligible for a credit on your property tax account through the council-approved 2005 Residential Property Tax Social Support Program.

Bylaws and public safety. Fair entry low income assistance. Who can sign up for a CUPS Virtual Tax Clinic.

Have experienced an increase in property tax from the previous year. Official web site of The City of Calgary located in Calgary Alberta Canada. Once approved they also receive a 25 rebate on the Citys waste and recycling fees.

The Seniors Property Tax Deferral Program allows eligible senior homeowners to voluntarily defer all or part of their residential property taxes including the education tax portion. Bylaws and public safety. PROPERTY TAX ASSISTANCE WASTE AND RECYCLING PROGRAMS INFORMATION GUIDE X 624G R2022-02 2 ISC.

The 2021 property tax bill due date is June 30. Add Calgary Property Tax payee to your bank accounts bill payment profile. Apply for property tax assistance Apply now.

Bylaws and public safety. The same subsidy value for each program as indicated in the following table. Add Calgary Property Tax as a payee.

Current Program Fees Calgary Transit Low Income Monthly Pass adultyouth Recreation Fee Assistance Property Tax Assistance Program incl. Property Tax Assistance Program. A creditgrant of the increase on the property tax for eligible low-income Calgarians.

If you are a residential property owner experiencing financial hardship regardless of age you may be eligible for a creditgrant of the increase on your property tax account. Own your own home and reside in your home. Beginning in 2017 and through to 2020 Calgary City Council implemented a tax relief program known as the Non-Residential Phased Tax Program PTP to help mitigate the increase in non-residential property taxes.

Have experienced an increase in property tax from the previous year. To be eligible for this program you must. Fair entry low income assistance.

The City of Calgary is supporting citizens and businesses in response to the COVID-19 pandemic. Before making payment at an ATM add Calgary Property Tax as a payee and register your current roll number online by phone or in person at a branch. All information submitted for property tax assistance is handled in a confidential manner.

Social programs and services. Figures show the City of Calgary approved 3400 applications from residential and non-residential property owners through its tax assistance program up from 700 in 2014. Own the property for a minimum of one year from date of purchase.

For more information about our programs visit property tax or Tax Instalment Payment Plan TIPP call 311 or 403-268-CITY 2489 if calling from outside Calgary. Social programs and services. Own your own home and reside in your home.

Eligible applicants receive a credit on the year-to- year increase on their property tax. Fair entry low income assistance. 800 Macleod Trail SE Calgary Alberta T2G 2M3.

Have experienced an increase in property tax from the previous year. The Tax Instalment Payment Plan TIPP suspended its 2 filing fee and there was no initial payment required for taxpayers who joined. Waste Recycling Rebate No Cost Spay Neuter Program Seniors Services Home Maintenance 44month 75 per cent off.

Own the property for a minimum of. For the 2021 tax year Council approved two municipal property tax relief measures to provide flexibility for property owners facing financial hardship. Property Tax Assistance Program.

Own no other City of Calgary residential property. Taxes and property assessment. This is done through a low-interest home equity loan with the Government of Alberta.

The City of Calgary offers financial assistance to low-income homeowners who see an increase in their property tax. Taxes and property assessment. Property Tax Assistance Program.

Call us at 311 or visit Calgarycafairentry. Web property for a minimum of one year from date of purchase. Senior citizens over 65 years of age are eligible for Property Tax Assistance for Seniors Program which offers rebates of tax increases based on 2004 tax.

Unrestricted Do you have more questions about the programs. SW Calgary T2R 0B7.

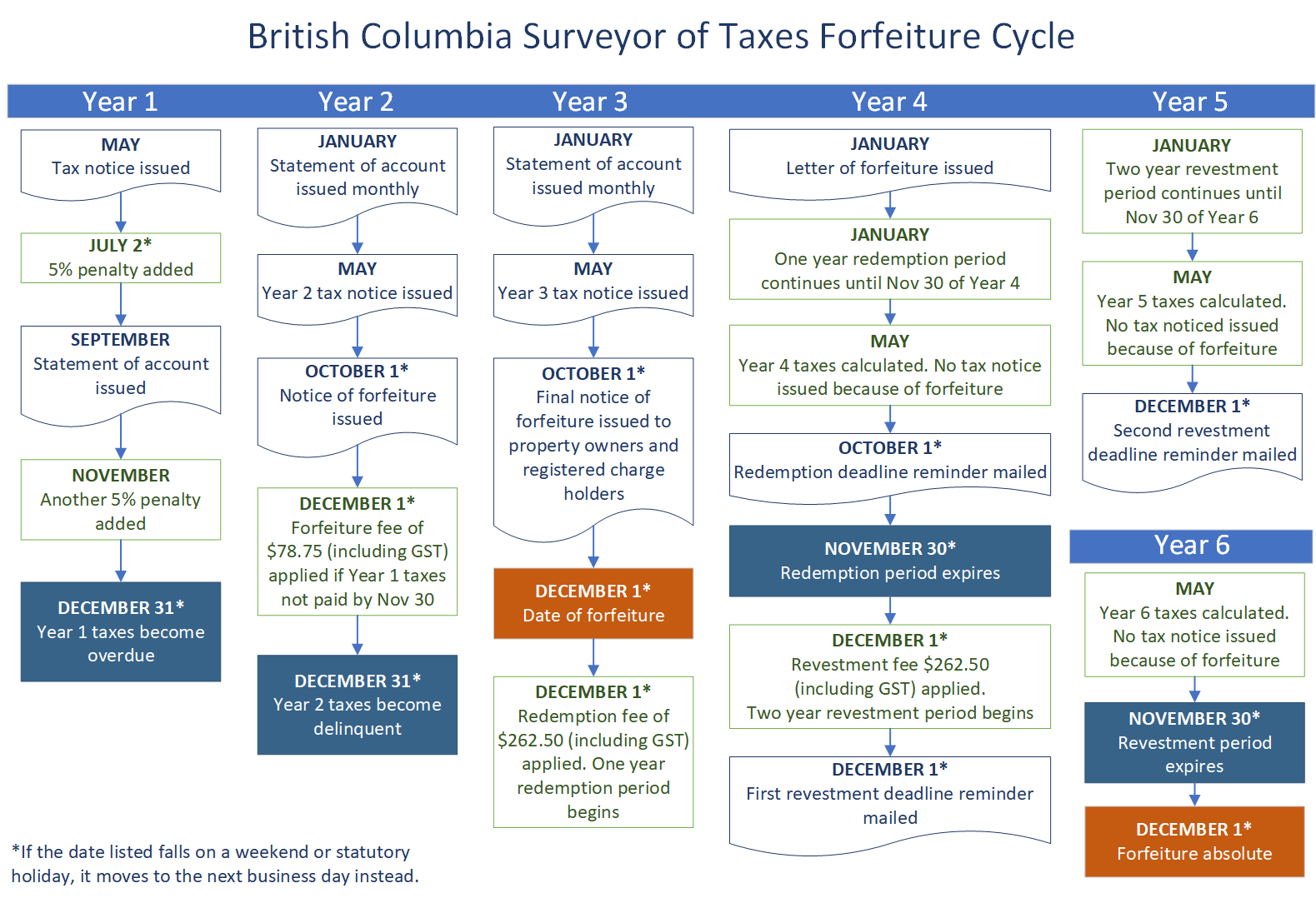

Overdue Rural Property Taxes Province Of British Columbia

Handful Of Communities To See Calgary Property Tax Increase Livewire Calgary

Delivering City Services And Determining Your Property Tax Bill

Why Homeowners Not Businesses Are Paying More And More Of The Property Taxes In Calgary Cbc News

Why Homeowners Not Businesses Are Paying More And More Of The Property Taxes In Calgary Cbc News

Coronavirus Canada Property Tax Deferrals By City Creditcardgenius

The Rent Is Too Damn High And City Taxes Are To Blame Frpo Federation Of Rental Housing Providers Of Ontario

How Our Property Tax And Utility Charges Measures Up Nationally

How Our Property Tax And Utility Charges Measures Up Nationally

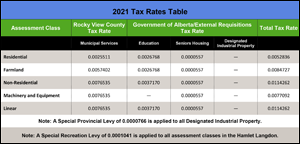

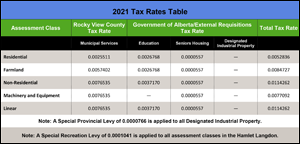

Property Tax Rates Rocky View County

Understanding California S Property Taxes

How Our Property Tax And Utility Charges Measures Up Nationally

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

How To Lower Your Property Taxes In Calgary

How Our Property Tax And Utility Charges Measures Up Nationally

Property Taxes Strathcona County

Does Alberta Have A Home Owners Grant For Property Taxes Cubetoronto Com