are political contributions tax deductible for corporations

This is based on the maximum allowable annual contributions of 19950. In the first 400 that you contribute 75 percent gets refunded.

Tax Deductions For Donations In Europe Whydonate

Arkansas Ohio and Oregon offer a tax credit while Montana offers a tax deduction.

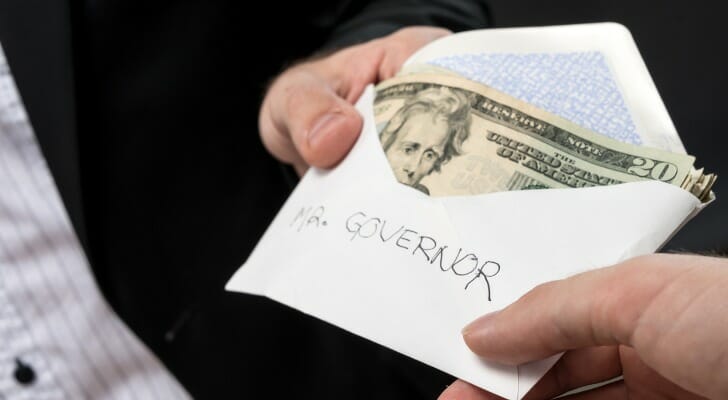

. You cant deductcontributions made to a political candidate a campaigncommittee or a newsletter fund. Are Political Contributions Tax-Deductible. You cant deduct contributions to organizations that arent qualified to receive tax-deductible contributions including political organizations and candidates.

Political contributions deductible status is a myth. Required electronic filing by tax-exempt political organizations. You can only claim deductions for contributions made to qualifying organizations.

In this manner are political donations tax deductible in 2018. But contributions to candidates and parties arent deductible no matter who makes them. The IRS makes it clear that you cannot deduct contributions that you make to any organizations that arent qualified to receive tax-deductible donations.

Contributions or expenditures made by a taxpayer engaged in a trade or business designed to encourage the public to register and vote in Federal state and local elections and to contribute to the campaign funds of the candidate or party of their choice are deductible by the taxpayer under section 162 a of the Internal Revenue Code of 1954. Some contributions can be made to the educational arm of a political organization when those arms are qualified under IRS Code section 501 c 3 or 4. 116-25 Section 3101 requires electronic filing by exempt organizations in tax years beginning after July 1 2019.

However the IRS does not allow contributions to any politician or. Generally you may deduct up to 50 percent of your adjusted gross income but 20 percent and 30 percent limitations apply in some cases. To a state local or district party.

Please note that this answer does not constitute legal. Campaign committees for candidates for federal state or local office. The Taxpayer First Act Pub.

It depends on what type of organization you have given to. This doesnt just mean that donations made to candidates and campaigns are excluded from being tax deductible. The short answer is no they are not.

Each year you can claim up to 650 in tax-free income. These business contributions to the political organizations are not tax-deductible just like the individual donations and payments. You can confirm whether the organization that you have been choosing for your donation.

Advertisements in conventionbulletins and admissions to dinners or programs that benefit apolitical party or political candidate arentdeductible. You may deduct charitable contributions of money or property made to qualified organizations if you itemize your deductions. A tax deduction allows a person to reduce their income as a result of certain expenses.

Political Campaigns Are Not Registered Charities. You can obtain these publications free of charge by calling 800-829-3676. Beside above are ActBlue.

Usually theyre not deductible. And political action committees are all political organizations subject to tax under IRC section 527. To be precise the answer to this question is simply no.

Contributions or donations that benefit a political candidate party or cause are not tax deductible. In each 400 contribution between 400 and 750 50 percent gets refunded. The amount of this non-refundable tax credit generally depends on the corporations total eligible contributions and its Ontario income tax payable for the tax year.

Tax season is a great time to make political contributions. Cost of admission to a political event including. Here are the main reasons why.

The longer answer is. Among other provisions this legislation specifically amended IRC Section 527 j to require the e-filing of Form 8872 Political. Up to 1000 can be claimed as a tax credit.

All four states have rules and limitations around the tax break. That includes donations to. Payments made to the following political causes are also not tax deductible.

The IRS which has clear rules about what is and is not tax-deductible notes that any contributions donations or payments to political organizations are not tax-deductibleThis means that if you donate to a political candidate a political party a campaign committee or a political action committee PAC these. 10000 combined To a national party. Though giving money to your candidate of choice is a great way to get involved in civic discourse donations to political candidates are not tax-deductible.

It is necessary to receive an official contribution receipt in order to claim your political contribution. A business tax deduction is valid only for charitable donations. The maximum tax credit that a corporation can claim in a tax year is 2294.

There are five types of deductions for individuals work. In most states you cant deduct political contributions but four states do allow a tax break for political campaign contributions or donations made to political candidates. Are Provincial Political Donations Tax Deductible.

For amounts over 750 33 will be charged. Charitable contributions are tax deductible but unfortunately political campaigns are not registered charities. Political contributions arent tax deductible.

According to the IRS. According to the IRS. According to the IRS.

Advertisements in a political convention program or politically affiliated publication. The tax credit will equal up to 75 percent of the first 200 contributed plus 50 percent of the next 900 and 3313 percent of the next 1200.

Tax Bill Could Make Dark Money Political Contributions Tax Deductible Cnn Politics

Are Political Contributions Tax Deductible Tax Breaks Explained

Are Political Contributions Tax Deductible H R Block

Are Political Contributions Tax Deductible Anedot

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

Are Political Contributions Tax Deductible Tax Breaks Explained

Are Political Contributions Tax Deductible Taxact Blog

Are Political Contributions Tax Deductible For Partnerships Ictsd Org

Federal And California Political Donation Limitations Seiler Llp

/not_for_profit_nonprofit_charity_AdobeStock_93906620-2ce63147cc814bd3b25984ee637c3bac.jpeg)

Charitable Contributions Tax Breaks And Limits

Are Political Contributions Tax Deductible

Are Political Contributions Tax Deductible Anedot

Are Political Contributions Tax Deductible Anedot

Are Political Contributions Tax Deductible H R Block

Are Political Contributions Tax Deductible Smartasset

Limits And Tax Treatment Of Political Contributions Spencer Law Firm

Are Political Contributions Tax Deductible Tax Breaks Explained

Are Political Contributions Tax Deductible Smartasset

Sample Samples Fundraising Letters Emmamcintyrephotography Personal Fundraising Letter Temp Fundraising Letter Personal Fundraising Sample Fundraising Letters